Applying Payment to an Invoice in QuickBooks It depends on whether you are applying money received from a vendor or paying on an outstanding balance. There are different steps that are dictated by accounts payable and accounts receivable. Managing Partial PaymentsĪ new customer usually has a few questions when dealing with a partial payment amount. Partial payments are commonly used in business, either put in place before a contract is signed or as pay installments to help a client struggling to pay their bills.

#Quickbooks for mac add payment method to pay bills window full#

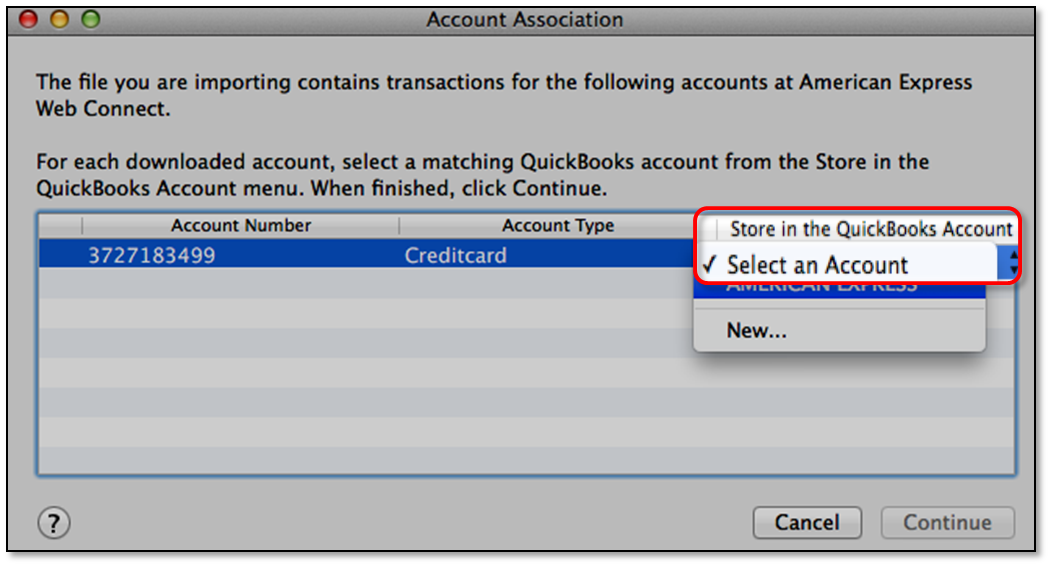

Partial payment is a payment towards an invoice for less than the full amount claimed by the creditor. Therefore, when using a system like QuickBooks Online, the ability to record a partial payment is essential. Enter the partial amount in the “ payment” column.Ĭustomer payments do not always adhere to the balance due.Click the “ +” icon and choose “ receive payment.”.(See Chapter 6, “Items: Your Products and Services,” from the QuickBooks 2010 for Mac user’s guide for complete information.Handling a partial payment in QuickBooks involves recording a customer’s payment on an invoice. You need to assign all of your items (in your Item List) to appropriate accounts.

If items from invoices show up in your checking account’s register as deposits, then you probably chose the checking account from the Account field pop-up menu when you set up those items. On the other “side,” each line item in the invoice’s columns appears in the account to which the item is assigned. In QuickBooks for Mac, an invoice becomes a single entry in the Accounts Receivable register for a specific customer job. Of course, if after reconciling your credit-card statement you entered a bill to pay later, then you won’t write a separate check you’ll use Pay Bills instead to generate a Bill Payment Check. However, when writing a check to pay down the card’s owing balance, enter the check into the bank account’s register and choose the credit-card account in the Account field. When entering a charge in the credit card’s register (or when using the Enter Credit Card Charges window), you’ll usually choose one or more expense accounts in the Account field. Credit card accountsĬredit-card transactions are similar.

Just make sure not to choose the bank account into which you’re entering the transaction, or you’ll see both sides offset each other in the register. Usually, you’ll choose income accounts for deposits and expense accounts for checks. (If you use the Make Deposits or Write Checks window, generally your default checking account shows in, respectively, the Deposit To or Bank Account field-i.e., the first “side.”) You need to supply the other “side” of the transaction by choosing the appropriate account (or accounts) in the Account field. When you enter a deposit or check into a bank account’s register, you’ve already chosen one “side” of the transaction. You just need to understand that the two “sides” of every transaction go to two (or more) different accounts. Conversely, credits increase income and liability accounts and decrease expense and asset accounts.įortunately, in QuickBooks for Mac you rarely need to worry about how or what to debit or credit. Debits increase expense and asset accounts but decrease income and liability accounts. Debits and credits affect different types of accounts differently. In double-entry accounting, every transaction records in at least two accounts-in one as a debit and in the other as a credit. QuickBooks uses double-entry accounting-the worldwide standard for business accounting. Finally, they create an invoice and see all of its line items show up as checking-account deposits. Then, they enter a credit-card charge and see a matching payment beneath. They write a check and see an offsetting deposit appear right below the check in the register. QuickBooks newcomers who enter transactions for the first time are sometimes mystified by what looks a bit strange.

0 kommentar(er)

0 kommentar(er)